How to buy Bitcoin with credit card

Investing in cryptocurrency has become popular among individuals and organizations. Bitcoin, in particular, has seen a significant increase in value over the past few years, leading many people to opt for direct trading and purchasing using credit or debit cards instead of mining. However, acquiring Bitcoin through these means may require a considerable amount of time and effort. Thankfully, companies such as Coinbase and Binance have made the process smoother and faster. You can now easily purchase Bitcoin using your credit or debit card from your account on any domestic or international exchange.

How to Buy BTC with a Credit Card using Coinbase?

It has become increasingly difficult to use credit cards to purchase cryptocurrencies such as Bitcoins, Ethereum, Ripple, and others through many banks. However, there are credit card providers that specialize in allowing customers to buy crypto with their credit cards. If you wish to purchase Bitcoins with a credit card, please follow these steps:

Step 1) Go to the Coinbase Platform

Open your browser and visit the following URL: https://www.coinbase.com/

Step 2) Create Your Coinbase Account

Create an account, verify your details, and log in to your account.

Step 3) Add a Payment Method

You will be prompted to add a payment method. Click on the “Add a Payment Method” button.

To proceed, please follow Step 4 which entails setting up your payment option. You can either add a Bank Account or a Credit/Debit Card. For this particular step, kindly choose the “Credit/Debit Card” method.

For Step 5, you will need to verify your identity. Simply click on the “Upload ID” button. We have pre-selected the option of using a driving license for this verification process.

To proceed, follow these steps:

Step 6: Upload the document. You may use your webcam, mobile camera, or a file to do so. Simply select your preferred option and upload the document.

Please proceed to Step 7 which requires you to input your Billing Address details. Once you have completed the verification process, kindly provide your credit card information and click on the “Add Card” button.

Step 8: Return to the Buy/Sell option and select Bitcoin to purchase it.

To complete your purchase, choose the desired amount and make the payment. After payment, the corresponding Bitcoin will be transferred to your Coinbase wallet. It may take a few minutes for your account to reflect the updated balance.

Please be aware that if you choose to purchase Bitcoin with a credit card, there will be an extra 3.99% processing fee applied. Additionally, in order to link your card, it is necessary to confirm your identity by providing a government-issued ID proof.

How to Buy Bitcoin with Debit Card / Prepaid Card using Binance

The process of using a Debit card to purchase Bitcoin is similar to that of a credit card. The only distinction is that instead of credit card options, we have the option to use Debit or Prepaid cards. To purchase Bitcoin using a Debit card, follow these steps: Step 1) Go to the Binance website and register by clicking on the “Register Now” button.

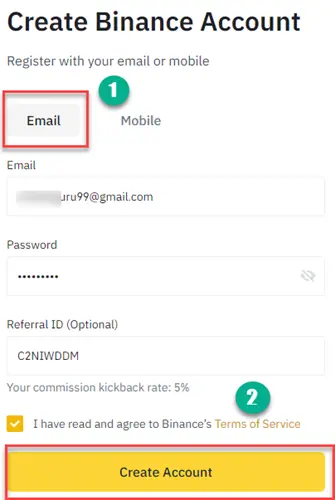

Step 2) Open a Crypto Trading Account with Binance

- Select the method as Email

- Enter your email id and password, then click on the “Create Account” button

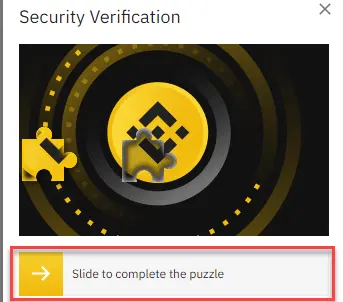

Step 3) As an extra security step, Binance asks you for the puzzle verification

For that, you just need to drag and drop the puzzle shown on your screen

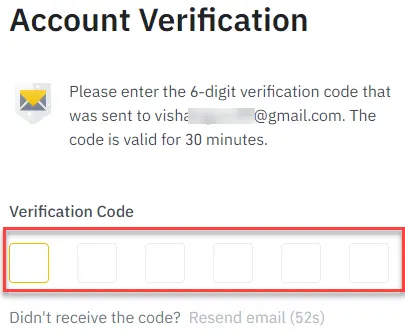

Step 4) Verify your Binance account by entering the verification code received on your email id

Step 5) Complete the registration process

Enter the billing details as a Credit/Debit Card option to proceed with your Bitcoin purchase

Step 6) Enter the fiat currency amount to purchase Bitcoin with a debit card and click on the “Continue” button.

Here, we have used Euro to buy Bitcoin. You can see the corresponding Bitcoin amount you will receive.

Step 7) Complete the transaction using your Debit Card, and you will receive the Bitcoins in your Binance wallet.

Top Exchanges to Buy Bitcoin Instantly with Debit Card or Credit Card

| Name | Deposit Methods | Fiat Currencies | Supported Cryptocurrencies | Link |

|---|---|---|---|---|

| Paybis | Bank transfer, Credit/debit cards, Payeer, and Skrill. | EUR, GBR, USD, and 44 others. | BNB, BTC, ETH, LTC, XRP, NEO, XLM, and TRX. | Learn More |

| Coinbase | Bank transfer, Credit card, Debit card, and Wire transfer | USD, EUR, AUD, GBP, HKD, INR, etc. | BTC, BCH, ETH, ETC, LTC, etc. | Learn More |

| Binance | Bank transfer (ACH), Credit card, Debit card, Cryptocurrencies, and PayID | USD, EUR, AUD, GBP, NZD + 40 others | Bitcoin, Litecoin, Ethereum, Ripple, etc. | Learn More |

| PrimeXBT | Credit Card, Debit Card, Bank Transfers, MoneyGram, Western Union, and cash deposits | AUD/USD, EUR, GBP, NZD, JPY, CA, etc. | BTC, ETH, LTC, and over 50+ other crypto assets | Learn More |

| CEX.io | Credit Card, Debit Card, and Bank transfer | USD. EUR, GBP, and RUB. | BTC, ETH, ADA, LTC, etc. | Learn More |

1) Paybis

Paybis is an online multi-cryptocurrency exchange platform that supports the buying and selling of cryptocurrencies. It offers numorous payment methods to trade Bitcoin and other altcoins.

Features:

- It keeps your data secure using security standards.

- Paybis offers a fast and easy registration process.

- Fast transactions and transparent fee structure

- It allows you to buy crypto from any place.

- You can verify your Paybis account in just a few clicks.

Key Statistics

Deposit Method: Bank transfer, Credit/debit cards, Payeer, and Skrill.

Transaction Fees: Charges a 2.49% for all credit/debit card transactions.

KYC and Verification Process: Need to provide full name, address, government-approved ID card for verification.

Security: Good

Customer Service: Chat and Email, and Social Media accounts.

Countries Supported: Albania, Bahamas, Barbados, Ghana, Iceland, Iran, Jamaica, North Korea, Mauritius, Mongolia, Myanmar, Panama, Sudan, etc.

2) Coinbase

Coinbase is a Bitcoin exchange platform that enables you to purchase, sell, transfer, and store digital currency. It has low fees compared to other exchanges. This platform also helps you to buy crypto using your credit/ debit card.

Features:

- Coinbase offers the fastest way to buy Bitcoin instantly with a credit card and helps you to keep track of them in one place.

- It allows you to securely store a wide range of digital assets in offline storage.

- It provides a safe way to buy Bitcoin online and schedule your crypto trading at any time of the day

- This crypto exchange stores your funds in a vault for safety purposes.

- Supported platforms: Web, Android, and iOS devices.

Key Statistics

Deposit Method: Bank Transfer (ACH), Credit and Debit card, and Wire Transfer.

Transaction Fees: Charges a 2% convenience fee on all credit card transactions.

KYC and Verification Process: Need a government-approved identity document for verification.

Security: Good

Customer Service: Chat and Email.

Countries Supported: Bahamas, Bermuda, Canada, Mexico, Panama, Trinidad and Tobago, United States, etc.

3) Binance

Binance is one of the best cryptocurrency exchanges, which allows you to buy BTC with a credit card or debit card. This Bitcoin exchange helps you to buy Bitcoin online. It also provides an API to integrate your current trading application.

Features:

- This crypto exchange offers a wide range of tools for buying and trading Bitcoin online.

- Provides basic and advanced exchange interfaces for trading.

- It is one of the best Bitcoin crypto buying exchanges that provides 24/7 support.

- Supported Platforms: Web, Android, and iOS.

Key Statistics

Deposit Method: Bank account transfer (ACH), PayID, Credit card, Debit card, and Cryptocurrencies.

Transaction Fees: Debit/ Credit card transactions may add an extra 3% fee. Moreover, 0.02% maker fee and 0.04% taker fee.

KYC and Verification Process: Identity document verification.

Security: Good

Customer Service: Chat and Email.

Countries Supported: Austria, Belgium, Bulgaria, Denmark, Finland, France, Germany, United Kingdom, Netherland, Romania, etc.

4) PrimeXBT

PrimeXBT is a cryptocurrency exchange to purchase Bitcoin with a credit card or debit card. It allows users to buy and trade multiple cryptocurrencies from a single account. You get easy access to many cryptocurrencies, stock indices, commodities, and forex on this platform.

Features:

- Helps you to improve your trading results by using 100x leverage.

- It allows you to buy cryptocurrency like BTC with a credit card.

- This crypto exchange allows traders to set up and manage a strategy.

- You can automatically copy the trading activities of experts to get the same returns.

- It helps you respond quickly according to changing market trends to profit from both rising and falling prices.

Key Statistics

Deposit Method: Credit and Debit Card, Bank Transfers, MoneyGram, Western Union, and cash deposits.

Transaction Fees: 0.001% to 0.05%.

KYC and Verification Process: No verification is needed or KYC Requirement.

Limits: You can make a maximum purchase of 10 BTC.

Security: Cold storage of digital assets with multi-signature technology.

Customer Service: You can reach out to Chat/Email customer support 24/7.

Countries Supported: Australia, Thailand, United Kingdom, South Africa, Singapore, Hong Kong, India, France, Germany, Denmark, United Arab Emirates, etc.

5) CEX.io

Cex.io is a cryptocurrency exchange that helps you to buy and sell Bitcoins. It is one of the best crypto exchange platforms that follows scalping and frequency trading strategies to secure assets and user data.

Features:

- It offers protection against DDoS(Distributed Denial-of-Service) attacks using full data encryption.

- It allows you to trade more than 10x leverage without creating an extra account.

- This application provides downloadable reports showing the real-time balance and transaction history of buying and selling your cryptocurrencies.

- Supported Platforms: Mobile devices and Web.

Key Statistics

Deposit Method: Credit Card, Debit Card, Bank transfer, and Skrill.

Transaction Fees: 0-0.16% maker fees and 0.10-0.25% taker fees. You can deposit $100/day with no ID verification.

KYC and Verification Process: No verification is needed.

Limits: Daily limit of deposit up to $3,000.00, and withdrawal limit up to $10,000.00.

Security: Average

Customer Service: Email and Chat support.

Countries Supported: Austria, Bulgaria, Denmark, Finland, Germany, Poland, Spain, Sweden, etc.

What are the Pros/ Cons of Buying Cryptocurrency using a Credit Card?

Pros of Credit Card Purchases

Here are some important pros of buying cryptocurrency with a credit card:

- It is a simple and the fastest way to buy Bitcoin online.

- It allows you to buy cryptocurrency, even if you don’t have cash.

- You can buy cryptocurrency using fiat currency.

- Reduced or waived foreign conversion fees.

- Multi-currency allows diversified investment options.

- Some credit card transactions waive off ATM withdrawal fees.

- Some credit cards offer significant cash back rewards in crypto.

- You don’t need to go through other third-party sites.

- You also get rewards and benefits that come with spending money using your credit card.

Risks involved in Bitcoin Credit Card Purchases

Here are some cons/ drawbacks of Bitcoin purchase using a credit card:

- Some credit card companies allow cardholders to make crypto purchases but treat these purchases as cash advances. This has several disadvantages. However, it might sound beneficial to cardholders.

- Cash advance fees: There are many credit card providers who consider a cryptocurrency purchase as a cash advance. That means that each crypto purchase is subject to a cash advance fee. This feels higher than a typical fee of either $10 or 5% (whichever is greater).

- Cash advance interest rates: Most credit cards have a higher annual rate for cash advances, mostly over 25%. It is the variable interest that also changes with the market. Moreover, your interest starts counting on the day when you buy crypto using your credit card and increases until the credit card bill is paid.

- Lower credit limits: Cash advances mostly have a lower credit limit than credit cardholders’ overall credit limit. Therefore, cardholders who want to make a big crypto purchase may be limited by the cash advance in terms and limitations.

- Foreign transaction fees: Specific foreign transaction fees can be applied whenever you buy crypto with your credit card. Moreover, foreign transaction fees are also applied if the vendor is from a different country and the credit card used at that time.

- High risk for fraud: There is a high chance of fraud if a vendor isn’t properly examined and the cardholder gives their personal/ confidential information like name, credit card number, CVV details, etc.

- High investment risk: Investing in crypto may lead to serious debt. Cardholders are charged fees and interest that they may not get back. This certainly increases credit utilization rate or loss of their investment value because of the volatile crypto market.

FAQ:

❓ Can I Use Debit Cards for Purchasing Bitcoin at a Bitcoin ATM?

Currently, No. As most Bitcoins ATMs only accept cash. However, you can use your credit card to get cash at a normal ATM and then use the cash to purchase Bitcoin at the Bitcoin ATM.

⚡ What Credit Cards allow Bitcoin Purchases?

You can buy Bitcoin with almost all credit cards like Visa, Master Card, American Express, Rupay, etc.

🚀 What are the Fees to Buy Bitcoin with a Credit Card?

The fee of purchasing Bitcoin with a credit card depends on the payment method and the crypto exchange you are buying from. For example, an ATM or exchange may charge either a fixed amount or a percentage of the purchase amount.

These fees can be $10 (Fixed) or 3-5% (Based on the transaction), whichever is greater. Credit card companies have also started to consider buying Bitcoin as a cash advance.

Also Check: Cheapest way to buy Bitcoin

🏅 Can you Earn Bitcoin Rewards with a Credit Card?

Yes, you earn Bitcoin rewards, but chances are very less, as only a few credit card providers offer a reward for purchasing Bitcoin using a credit card.

» Check here our list of the Best Crypto Debit/Credit Card

❓ Can I Use Prepaid Card to Buy Bitcoin?

Yes, The process of buying Bitcoin with a prepaid card is similar to buying crypto with a debit or credit card. The only difference is that we can count a selection of prepaid card options instead of credit card selections.

Also Check: Best Crypto (Bitcoin) Friendly Banks in US, Canada, Europe

❗ Is it Risky to give up my ID to buy Bitcoin instantly with a Credit Card?

It completely depends on how much you trust the exchanges. Like any other information you share online, there is always the risk that it can be either stolen or hacked from the website you have given.

Moreover, Bitcoin exchanges are prone to security flaws because they are constantly under attack. Therefore, there is always a risk of anything related to information online.